The Grameen Bank established a housing loan programme in 1984 to enable poor rural families to own permanent and cyclone-proof homes. To date 617,000 such homes have been completed and the programme is continuing with building over 30,000 new homes each year. The maximum housing loan available is $249, which is repayable over 5 years at an interest-rate of 8 per cent. The title to the home is vested with the woman who thereby obtains financial security and improved status within the family and society.

Aims and Objectives

The Grameen Bank Housing Programme was started with the following aims:

- To bring housing within the reach of the rural poor;

- To support the building of houses that are durable, safe and do not need a high recurring expenditure on repair and replacement;

- To permit the house to be built and maintained using locally available skills and materials;

- To sustain the wellbeing and pride of the inhabitants in order to enhance and sustain their motivation for economic activity.

With a population in excess of 130 million and per capita income of $400, Bangladesh is one of the poorest, most densely populated and least developed nations in the world. Situated in a low-lying delta where four major river systems come together, the country is blessed with highly fertile soil, but also suffers regular and severe problems of flooding. Despite their many problems the people of Bangladesh retain considerable optimism and pride in their nation.

Grameen Bank grew out of an action research project initiated by Professor Muhammed Yunus in 1976, who recognised that it is poor people’s lack of access to capital rather than their capacity to repay that perpetuates their poverty. Initiated at the Chittagong University, the research action project started with the provision of credit facilities for a small number of poor rural families. These tiny loans of a few dollars, issued without formal collateral, enabled the poor to set up small income-generating businesses and get out of their downward spiral of poverty and exploitation by money lenders. Building on the success of this and subsequent projects, the Grameen Bank was formally incorporated in 1983 and is today the largest rural credit institution in Bangladesh with 4.21 million borrowers, 96 per cent of whom are women. It provides services in 50,936 villages (more than two thirds of all villages in Bangladesh). The total amount of loan disbursed by the Grameen Bank, since inception is $4.74 billion, of which $4.25 billion has been repaid. In March 2005 the total loan disbursement was $48 million.

Grameen Bank operates as a specialised bank for the poor, charging interest on its loans and is not reliant on donor funding. It specialises in the provision of financial services, including credit, savings and insurance to the poorest of the rural poor (the word ‘Grameen’ means village). It obtains funds from the Central Bank of Bangladesh and lends them on to its borrowers at a higher rate of interest. It is able to operate profitably due to its high loan recovery rate of 98.89 per cent and makes a small annual profit.

In 1984 the Bank started to lend money for housing loans and to date 617,000 houses have been built using these loans. The maximum amount given for a housing loan is $249. This has to be repaid over a period of 5 years in weekly instalments with an interest rate of 8 per cent. To date, a total of $130 million has been disbursed for housing loans. The housing loans are available only to existing Grameen Bank borrowers who have a 100 per cent repayment record and have completely repaid their first two loans for income generation activities. After a natural disaster Grameen Bank has a special housing programme in which the above criteria are relaxed.

Poor families typically live in small shelters of jute stick, straw, grass thatch, bamboo and dried mud. Each year a family has to spend about $30 to repair the house after the monsoons. For an equal amount of money a family can repay a housing loan for a strong, well-constructed house with a floor area of 20m?. The Bank views housing loans as investment rather than consumption, since a secure and well-constructed house aids the health and well-being of the family and helps them break the vicious circle of poverty. The house can be used for storage for their small businesses and time and money are saved in not having to continually repair the jute-stick shelters. The Grameen Bank has developed two standard house designs. The smaller one costs $300 and a larger version costs $625. In many cases the family add their own savings to the loan and are spending up to $800 – $1,000 on their home and its furnishings.

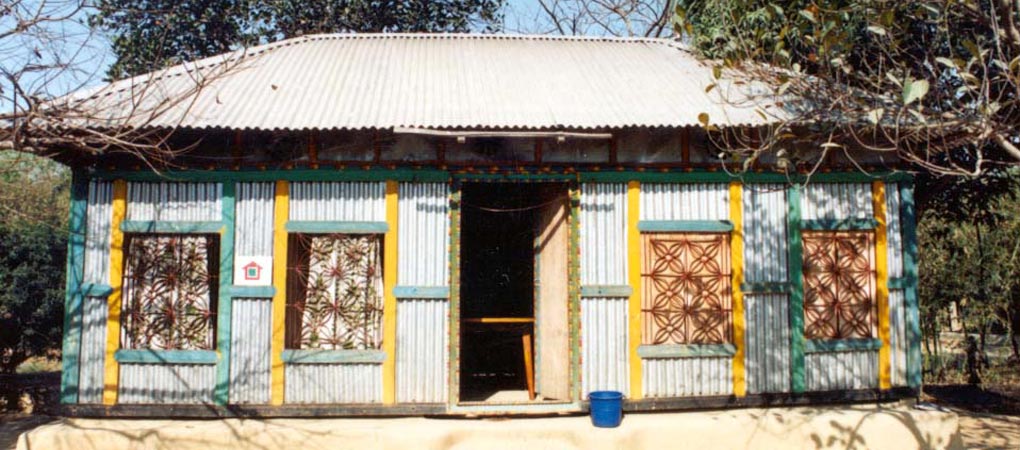

The houses vary in appearance throughout the country but have the same basic structural components. There are four reinforced concrete pillars on brick foundations at the corners of the house and six intermediary bamboo or concrete posts, with bamboo tie beams, wooden rafters and purlins supporting corrugated iron roofing sheets. This provides stability in the flood and strong monsoon wind and protection from the heavy rain during the monsoon season. In cases of severe flooding the house can be dismantled and the components stored and reassembled later. A sanitary latrine must be provided with each house. Families can build the houses themselves, with the help of friends and neighbours. Local skilled carpenters carry out the roof construction for many families. Many houses now have an electrical connection which powers an electric light, a fan and occasionally a TV or radio. All houses had raised sleeping areas so that the family did not have to sleep on the floor and in each house there is a table with school books for the children to work on when they came in from school. Loans are also available to purchase homestead land if a family has no land on which to build its house.

The title to the house is vested with the borrower and in 96 per cent of the cases this is the woman. This unique scheme helps women obtain financial security and an improved status within the family and society. The borrowers repay their loans on a weekly basis at the Centre meeting when the manager of the local branch office of the Grameen Bank comes to their village. The collateral system of peer support means that families help each other out with payments if necessary to ensure that all repayments are made on time. There is a 98.89 per cent loan recovery rate, compared to a 25-30 per cent for other banks.

The Grameen Bank employs 13,124 people, most of whom are based in the branch offices in the rural areas. All the staff have a sense of pride and mission in their work and an identity with the borrowers. Branch staff treats the borrowers with respect and are held in high regard. The organisation prides itself on being free of corruption and is innovative and progressive. It is constantly seeking to develop new opportunities for income generation and services for its borrowers and has established sixteen new enterprises to provide these services on a commercial basis including electricity supply using solar energy, a mobile phone network for the villages and a marketing organisation for the high quality hand-woven fabrics, which are manufactured in the villages.

Why is it innovative?

- The provision of small business loans to the poor based on mutual trust and peer support as a guarantee of repayment.

- The provision of loans on an affordable basis for the construction of permanent and disaster-resistant housing.

- The high-level inclusion of women in promoting self-employment and provision of home loans.

- The extensive replication of the project across the world including the countries of the North.

Is it financially sustainable?

The Grameen Bank operates on a commercial basis. There is a 98.89 per cent recovery rate on its loans, ensuring the financial viability of the organisation and its continued expansion. In 1995 the Grameen Bank made a decision not to receive any further donor aid or loans and its growing deposits are more than enough to run and expand its credit programme. The loans taken out by households serve to significantly improve their economic conditions and increase their financial self-sufficiency.

What is the social impact?

The Grameen Bank’s micro-credit programme has evolved to lift millions of people living in rural areas of Bangladesh out of poverty. Through its banking system that is based on mutual trust, accountability and participation, the Bank has created a revolution that has dramatically improved the socio-economic conditions of the poor, especially women who had previously had no access to mainstream financial institutions.

Transfer

The Grameen Bank micro-credit model is now replicated in 59 other countries around the world. The Grameen Trust has been established to promote micro-credit for the poorest of the poor throughout the world, in countries of the North as well as the global South. Its international success is reflected in the fact that the United Nations has established 2005 as the UN International Year of Micro-Credit.

Partnership

Private sector, local community